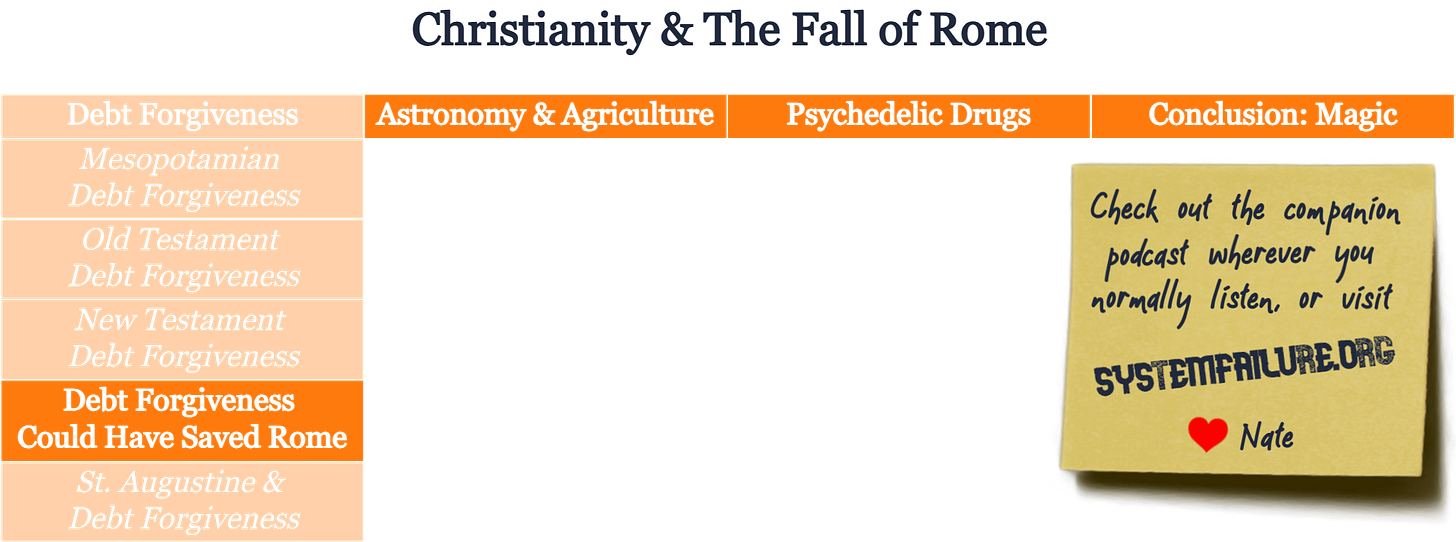

Forgiveness vs Foreclosure

How Debt Forgiveness Could Have Saved Rome

Preamble

Death and rebirth are central themes of Christianity, both in its mythology—the story of Jesus is about coming back from the dead—and its actual history; Christianity resurrected some notable Jewish and Greco-Roman traditions, dusted them off, and transported them forward into the Middle Ages and beyond.

Three major examples—all readily allegorized by death and rebirth—are debt forgiveness, astronomical cycles, and ego death.

Christianity originated within the Roman Empire, which eventually collapsed because of debt, according to its own historians. The Romans were pioneers in forgoing the stability afforded by systematic debt forgiveness. From Mesopotamia to Classical Greece, virtually all preceding societies used it to stave off economic collapses like the one that eventually befell Rome.

This Mesopotamian tradition arrived in the Roman Empire through Jewish scripture and, amazingly, the figure of Jesus. However, Rome's fate was sealed when the financial forgiveness he preached was conveniently reinterpreted to mean forgiveness for sexual immorality instead. That’s how the Fall of Rome shaped Christianity as we recognize it today.

The Danger of Debt

According to its own historians, Roman society collapsed because of debt. In the aftermath of the Fall of Rome, debt got such a bad name that the Roman Catholic Church considered usuary a sin for a thousand years. “Livy, Plutarch and other Roman historians,” wrote Dr. Michael Hudson in ...and Forgive Them Their Debts, “blamed Rome’s decline on creditors using fraud, force and political assassination to impoverish and disenfranchise the population.”

Too much wealth inequality is an existential threat to any society. To prevent their civilizations from being consumed by it, the kings of Bronze Age Mesopotamia established a long tradition of regular debt forgiveness. In the 6th century BC, that idea reached as far west as Greece. But then Rome broke with Athens by engaging in the risky practice of unprotected finance.

In their 1944 classic Caesar & Christ, legendary historians Will and Ariel Durant wrote, “Wealth mounted, but it did not spread; in 104 BC, a moderate democrat reckoned that only 2,000 Roman citizens owned property.” Four or five million propertyless people lived at the mercy of just a couple thousand elites who owned everything. That hideous wealth inequality ultimately removed any incentive for most Romans to defend their society from external threats. No one wanted to fight or die for a society in which they didn’t share the spoils.

Roman Slavery

Slavery was the specific mechanism by which debt destroyed Rome. As Roman society expanded militarily, slaves were a highly sought-after commodity. Precious metals and other non-slave commodities could be looted from conquered territories and sold once. Slaves captured from those territories, on the other hand, generated income for a lifetime.

About a quarter of the Roman population was enslaved at any one time. And about half of those enslaved worked on the latifundia, or massive slave farms, where Rome’s food was grown.

Rome’s small farmers were ruined when agricultural produce grown by slaves hit the grain markets. They couldn’t hope to compete with slave labor. The generals and politicians who owned the latifundia didn’t have to pay their farmhands; they could afford to sell their slave-grown grain at a price far lower than free farmers could sell theirs. The introduction of slaves, in other words, rendered the free farms of Rome economically non-viable.

The introduction of slavery dramatically altered the economic landscape of Rome, particularly in the 1st and 2nd centuries BC. Through no fault of their own, the small farms tilled by free Roman citizens passed from economic viability to financial ruin during that time.

Foreclosure

The Roman oligarchy established an innovative set of legal principles to preserve the sanctity of assets like debt. We still use their legal system today; our legal terms are all in Latin, the language of Rome.

As the small farmers of Rome were ruined en masse, the Roman legal system transferred all those farms to creditors. The mortgage contracts for those farms were written when their profits were sufficient to make the mortgage payments. But after the introduction of slavery removed those profits, mortgage contracts defaulted, and a wave of foreclosures broke over Roman society.

During the foreclosure proceedings, the unconscious logic of Roman jurisprudence systematically delivered the bulk of Rome’s small farms to creditors who were already wealthy. Their legal system was utterly blind to the dire consequences of extreme wealth inequality.

Forgiveness

The Bronze Age kings of Mesopotamia understood that there was an alternative to the dangers of extreme wealth inequality. That alternative was constantly writing down debt to match the actual ability of debtors to repay it—or, in other words, to “forgive” those debts. Solon of Athens used that strategy in Greece. However, the Romans became historical pioneers by not forgiving debt and instead upholding its sanctity with a rigid legal system.

Forgiveness was central to the message of Jesus Christ, who lived out his short life on the outer rim of the Roman Empire. During his debut sermon in his hometown of Nazareth, Jesus read a passage from Jewish scripture commanding debt forgiveness. Furthermore, his Lord’s Prayer contains the line, “Forgive us our debts, as we forgive our debtors”. Jesus advocated for the precise economic reform that could have prevented the economic turmoil he and his contemporaries lived through.

A different legal system might have taken into account the fact that slavery had radically changed the economic paradigm and that small farmers were defaulting on their mortgages by no fault of their own. If it had written down their debts to match their actual ability to pay, Rome’s free farmers could have remained on their farms instead of being forced off their property and into urban slums.

Under a forgiveness scenario, Rome’s wealthy creditors would have been forced to take a haircut on the debts owed to them. Said another way, they would have had to recognize a portion of the economic losses caused by their widespread deployment of slaves. Instead, they “double-dipped”. The Roman elite kept all the profits from the latifundia for themselves…and then took over the farms of those whom the latifundia had ruined. It was a recipe for social and economic chaos; the worst nightmares of the kings of Mesopotamia came true in Rome.

The 2008 Financial Crisis

During the 2008 financial crisis, America faced a similar choice between forgiveness and foreclosure. The root of that crisis was the fraudulent issuance of subprime mortgages to lenders who could ill-afford them. When it turned out lenders had been writing unpayable loan contracts, the worldwide economic system imploded.

We addressed the problem by purchasing distressed debt from investment banks using public funds, which is the essence of “Quantitative Easing." Throughout its history, the US Federal Reserve was limited to buying only US Treasury bonds, known as “Open Market Operations.” However, following the 2008 financial crash, new legislation permitted the government to acquire mortgage-backed securities directly from investment banks at face value. Approximately $4.5 trillion of public funds was allocated to Quantitative Easing between 2008 and 2014.

We could have, however, simply forgiven the unpayable mortgages causing the issue. That would have cost an order of magnitude less public money. But just as in Rome, wealthy creditors wield enormous influence over our government, and they prefer foreclosure over forgiveness. As a result of their policy preference, some 10% of all US mortgages went into foreclosure during the 2008 financial crisis.

We’re still grappling with the same political and economic forces that once preoccupied Jesus and toppled the Roman Empire. In one of his epistles, the Roman poet Horace wrote, "Mutato nomine, de te fabula narrator." That means, "Change the name, and the story is told about you."

Further Materials

[Rome’s] historians describe how disenfranchising indebted citizens led to the hiring of mercenaries (often debtors expropriated from their family homestead) as wealthy creditors concentrated land in their own hands, along with law-making power and control of state religion. What, instead, threatened the security of widely-held property and ultimately led to collapse was the financial oligarchy’s ending of the power of rulers to restore liberty from bondage and to save debtors from being deprived of land tenure on a widespread scale.

Michael Hudson, …and Forgive Them Their Debts, 2018, page 15

The creditor-sponsored counter-revolution against democracy led to economic polarization, fiscal crisis, and ultimately to being conquered – first the Western Roman Empire and then Byzantium. Livy, Plutarch and other Roman historians blamed Rome’s decline on creditors using fraud, force and political assassination to impoverish and disenfranchise the population. Barbarians had always stood at the gates, but only as societies wekened internally were their invasions successful. The invasions that ended the fading Roman Empire were anticlimactic. In the end, the only debts that Emperor Hadrian could annul with his fiscal amnesty were Rome’s tax records, which he burned in 119 AD – tax debts owed to the palace, not debts to the creditor oligarchy that had gained control of Rome’s land.

Michael Hudson, …and Forgive Them Their Debts, 2018, page 16

This is what the U.S. President Obama did after the 2008 crisis, Homeowners, credit-card customers and other debtors had to start paying down the debts they had run up. About 10 million families lost their homes to foreclosure. Leaving the debt overhead in place meant stifling and polarizing the economy by transferring property from debtors to creditors.

Today's legal system is based on the Roman Empire's legal philosophy upholding the sanctity of debt, not its cancellation, Instead of protecting debtors from losing their property and status, the main concem is with saving creditors from less, as if this is a prerequisite for economic stability and growth. Moral blame is placed on debtors as if their arrears are a personal choice rather than stemming from economic strains that compel them to run into debt simply to survive.

Something has to give when debts cannot be paid on a widespread basis. The volume of debt tends to increase exponentially, to the point where it causes a crisis if debts are not written down, they will expand and become a lever for creditors to pry away land and income from the indebted economy at large. That is why debt cancellations to save rural economies from insolvency were deemed sacred from Sumer and Babylonia through the Bible.

Michael Hudson, …and Forgive Them Their Debts, 2018, page 18